Navigating Market Cycles: How to Adjust Your Investment Strategy Without Overreacting

Why Market Cycles Matter to Your Financial Plan

As a CERTIFIED FINANCIAL PLANNER™, I’ve helped many clients weather market highs and lows. One of the most important lessons I teach is that while the market may be unpredictable in the short term, it tends to follow repeatable patterns over time. These patterns—called market cycles—can help guide your investment strategy.

But here’s the catch: reacting emotionally to those cycles often causes more harm than good. Instead, I help my clients make intentional, strategic adjustments to their portfolios. Let’s explore how market cycles work, when it’s appropriate to make changes, and how to keep your investment plan aligned with your long-term goals.

Understanding Market Cycles

Identifying Where We Are in the Cycle

Recognizing which phase of the market cycle we’re currently in can be tricky—even economists and analysts don’t always agree. In fact, recessions are often only officially declared after they’ve already begun, based on data that's reported with a lag.

That said, there are some clues that can help you assess the broader economic environment:

- Expansion indicators: Rising GDP, low unemployment, increasing corporate earnings, rising consumer confidence

- Peak indicators: Slowing growth, high inflation, rising interest rates, stretched valuations

- Contraction indicators: Declining GDP, rising unemployment, reduced consumer spending, falling corporate profits

- Trough indicators: Stabilizing economic data, market bottoms forming, improving business outlook

While no single data point can confirm a phase, reviewing a combination of trends with your financial advisor can help guide your strategy without reacting prematurely. Markets generally move through four recurring phases:

- Expansion – The economy grows, stocks rise, and optimism builds.

- Peak – Economic growth slows, valuations stretch, and inflation may rise.

- Contraction – The market dips, layoffs rise, and recession fears increase.

- Trough – The bottom forms, setting the stage for recovery.

These cycles are natural—and expected. Trying to time them perfectly is almost impossible. Instead, focus on recognizing where we are and how to adjust without overreacting.

When (and How) to Rebalance Your Portfolio

Rebalancing is the process of adjusting your portfolio back to its original asset allocation. This is important because when one asset class (like stocks) outperforms, your risk profile may shift. Rebalancing ensures you’re not accidentally taking on too much risk—or being too conservative.

When to Rebalance:

- Annually or semi-annually

- After major market moves (10%+ gain/loss)

- After significant life changes (job change, inheritance, retirement)

How to Rebalance:

- Sell overweighted assets and buy underweighted ones

- Redirect new contributions to lagging assets

- Use target-date or managed funds that rebalance automatically

Evaluating Your Portfolio Through Each Cycle

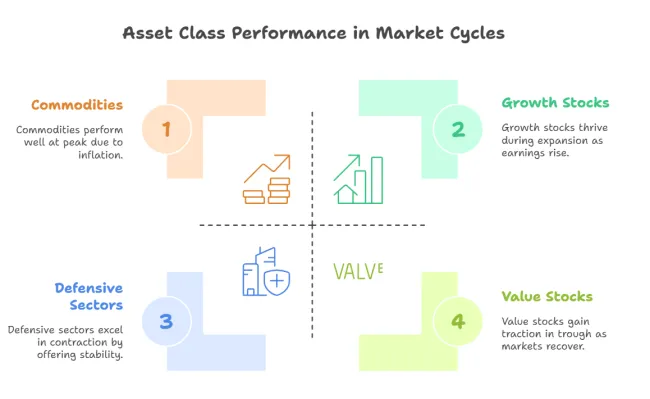

Understanding how different asset classes have historically performed during market cycles can provide useful context for long-term investors. While past performance is not a guarantee of future results, patterns often emerge over time that can help guide strategy adjustments. Here's a general breakdown:

- Expansion: Equities—especially growth stocks—tend to perform well as earnings rise and consumer confidence grows.

- Peak: Commodities and inflation-protected assets like TIPS (Treasury Inflation-Protected Securities) have historically held up as inflation increases and interest rates rise.

- Contraction: Defensive sectors such as healthcare, utilities, and consumer staples often outperform more volatile areas, as people continue spending on essential goods and services.

- Trough: Value stocks and small-cap equities may lead as the market recovers, and investors seek undervalued opportunities.

While history can be a guide, it’s not a blueprint. Every cycle has its own unique drivers—from geopolitics to interest rates to innovation. Diversification across sectors and asset classes remains your best protection against the unexpected. Each market phase has unique characteristics. Here’s how you might think about your investments during each phase:

- Expansion: Stay invested but avoid chasing hot stocks.

- Peak: Consider rebalancing; evaluate fixed income exposure.

- Contraction: Resist selling in panic. Focus on fundamentals.

- Trough: Opportunity to invest more while prices are low.

Update Risk Tolerance and Goals Regularly

Your financial plan isn’t “set it and forget it.” Risk tolerance changes with life stages, income, and even market experiences. A 30-year-old investing for retirement may handle a downturn differently than a 55-year-old nearing retirement.

It’s essential to update your:

- Investment goals

- Risk tolerance assessments

- Time horizons

An outdated plan can lead to decisions that don’t serve your best interests.

Behavioral Finance: Avoiding Emotional Mistakes

Investors are human—and that means emotions can drive decisions. Behavioral finance shows us that fear, greed, and herd mentality often lead to costly mistakes.

Common Pitfalls:

- Selling at the bottom (fear-based)

- Over-concentrating in "hot" assets

- Ignoring diversification

What Helps:

- A written investment plan

- Automatic contributions

- Regular reviews with a planner

Tools Advisors Use to Monitor and Adapt

Working with a professional gives you access to:

- Portfolio risk analysis tools

- Market trend evaluations

- Tax-efficient rebalancing strategies

- Retirement income simulations

These tools help keep your portfolio aligned with your goals and market conditions—without knee-jerk reactions.

Myths & Facts About Investing Through Market Cycles

Want a reality check on how difficult timing the market really is? According to a 2022 DALBAR study, the average equity investor underperformed the S&P 500 by nearly 4% annually over the past 20 years—largely due to emotional trading and poor market timing.

JP Morgan's "Guide to Retirement" reports that missing just the 10 best days in the market over a 20-year span can cut your return by more than half. Even more striking, 7 of those 10 best days often occur within two weeks of the worst days. This underscores the importance of staying invested—even when it feels most uncomfortable.

- Myth: “I should sell before the next crash.” Fact: Market timing rarely works and often hurts long-term returns.

- Myth: “Bonds are always safer.” Fact: Bond values can drop when interest rates rise.

- Myth: “I’ll reinvest once the market recovers.” Fact: Most gains happen early in recoveries—waiting often means missing out.

Final Thoughts: Smart Adjustments, Not Emotional Reactions

Your investment strategy should evolve—but never based on fear. Understanding market cycles allows you to make data-driven decisions that support your financial goals.

If you’re unsure how your portfolio stacks up in the current cycle, or you’re wondering whether you need to rebalance, that’s where I can help.

📩 Schedule your free consultation today:

Let’s turn financial anxiety into confidence.

FAQs

Q: How do I know if I should rebalance my portfolio?

A: You should consider rebalancing at least once per year or after large market shifts. It's also smart to reassess after major life changes like a new job or retirement.

Q: What does it mean to have a diversified portfolio?

A: Diversification means spreading your investments across different asset types (stocks, bonds, sectors) to reduce risk.

Q: Should I move to cash when the market drops?

A: Historically, moving to cash during downturns results in missed gains. Staying invested and riding out the cycle typically yields better long-term returns.

Q: Can I invest differently depending on my age?

A: Absolutely! Your age, income needs, and risk tolerance should influence your portfolio’s asset allocation.

Q: How do I stay calm during market volatility?

A: A written plan, diversified portfolio, and regular check-ins with your financial planner can help reduce emotional decisions.