CELEBRATING FINANCIAL MILESTONES: EMBRACING FINANCIAL FREEDOM

Happy Fourth of July! As we celebrate our nation’s independence, let’s also take a moment to appreciate another kind of freedom— financial freedom. Whether you’ve just paid off a small debt or achieved a major financial goal, every milestone is worth celebrating. Just as fireworks light up the sky, let’s light up our lives with the joy of financial achievements, big or small.

Goal planning is one of my favorite part of the financial planning process! Goal planning allows clients to do a little bit of dreaming and reaching for ideas or scenarios that they assumed was not in their grasp. Asking clients, "If you had a magic wand..." opens doors and goals that provide an new level of freedom. Planning for these goals and dreams happens in smaller sections, and along the journey we create financial milestones to keep us moving in the right direction.

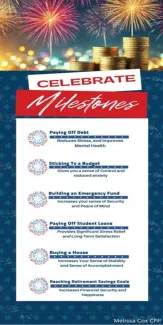

The Importance of Celebrating Financial Milestones

Just as the Fourth of July reminds us of the hard-won victories of our forefathers, celebrating financial milestones recognizes the effort and discipline required to achieve financial goals. Acknowledging these successes keeps us motivated and on track. It’s not just about the destination, but enjoying the journey and appreciating the progress we make along the way.

Small Wins, Big Joy: Celebrating Everyday Financial Milestones

Paying Off a Credit Card

Finally seeing that zero balance on your credit card statement? That’s worth a cheer! Paying off debt, no matter how small, is a step toward financial freedom. Celebrate by treating yourself to a nice dinner or a small reward that fits your budget.

Creating and Sticking to a Budget

Managed to stick to your budget for a month? Great job! Budgets are the roadmap to financial success. Take a moment to celebrate your discipline and maybe splurge on a little something from your “wants” list.

Building an Emergency Fund

Started an emergency fund? Fantastic! Even if it’s just a few hundred dollars, having a safety net is a huge step. Reward yourself with a fun, low-cost activity like a movie night or a picnic in the park.

Big Achievements: Celebrating Major Financial Milestones

Paying Off Student Loans

Student loans can feel like a never-ending burden, so paying them off is a massive accomplishment. Celebrate this milestone with a big bang—perhaps a small vacation or a special purchase you’ve been eyeing.

Buying Your First Home

Owning a home is a significant achievement and a hallmark of financial stability. Throw a housewarming party or treat yourself to some new home décor to commemorate this milestone.

Reaching Retirement Savings Goals

Saving for retirement is a long-term endeavor, and hitting your goals is a reason to celebrate. Mark this milestone with something memorable, like a special dinner with loved ones or a weekend getaway.

Fun Ways to Celebrate Financial Milestones

Celebrations don’t have to break the bank. Here are some budget-friendly ideas to mark your financial achievements:

Host a Potluck Party

Invite friends and family over for a potluck celebration. Everyone brings a dish, and you get to share your financial victory with your loved ones without spending a fortune.

Create a Milestone Memory Book

Document your journey by creating a scrapbook or digital album of your financial milestones. Include photos, notes, and memories that remind you of your achievements.

Plan a “No-Spend” Adventure

Challenge yourself to a fun, no-spend day where you explore free activities in your community, like hiking, visiting a museum, or attending a local event.

The Ripple Effect of Celebrating Financial Success

Celebrating financial milestones isn’t just about enjoying the moment—it’s about building positive financial habits that have a lasting impact. Each celebration reinforces the behaviors and decisions that led to your success, making it more likely you’ll continue on the path to financial freedom.

Encouraging Others to Celebrate Their Milestones

Share your successes with friends and family to inspire them on their financial journeys. Whether it’s a social media post, a phone call, or a casual conversation, your story can motivate others to set and achieve their own financial goals.

Conclusion

As we celebrate Independence Day and the freedom it represents, let’s also embrace the freedom that comes from financial success. Whether you’re just starting your financial journey or you’ve achieved significant milestones, every step forward is worth celebrating. Here’s to lighting up our financial futures with the same enthusiasm and joy that we bring to our Fourth of July celebrations. Cheers to financial freedom and the many milestones along the way!

If you feel stuck in creating a road map to reach your goals. Please call or email to schedule an appointment with me, and let's create a financial plan that makes you feel comfortable and confident in your financial future.

FAQs

- Why is it important to celebrate financial milestones? Celebrating financial milestones keeps you motivated, reinforces positive financial behaviors, and helps you enjoy the journey toward financial freedom.

- How can I celebrate financial milestones without overspending? Host a potluck party, create a milestone memory book, or plan a no-spend adventure to celebrate without breaking the bank.

- What are some small financial milestones worth celebrating? Paying off a credit card, sticking to a budget, and starting an emergency fund are all small wins that deserve recognition.

- What should I do after reaching a major financial milestone? Celebrate your achievement with something memorable, then set new financial goals to keep progressing.

- How can sharing my financial success help others? Sharing your financial milestones can inspire and motivate others to pursue their own financial goals, creating a positive ripple effect.

Until next time...this is Melissa Making Cents!

Melissa Anne Cox CERTIFIED FINANCIAL PLANNER™ is also a College Planning and Student Loan Advisor in Dallas, Texas