Spring Cleaning Your Finances

Introduction: A Fresh Start for Your Finances

As a Certified Financial Planner™ (CFP®), I often tell clients that financial planning isn't just about numbers—it’s about creating clarity, reducing stress, and aligning money with life goals. Just like spring cleaning your home clears out clutter and resets your space, spring cleaning your finances is an opportunity to refresh, organize, and optimize your financial life.

Whether you feel overwhelmed by paperwork, have accounts scattered across multiple institutions, or just want to ensure you’re on the right track, these five steps will help you get your finances in order this season.

Step 1: Declutter Your Financial Accounts

Why It Matters:

Having multiple accounts can make it harder to track your progress and manage money efficiently. Simplifying your accounts helps streamline your financial picture and reduces unnecessary fees.

Action Steps:

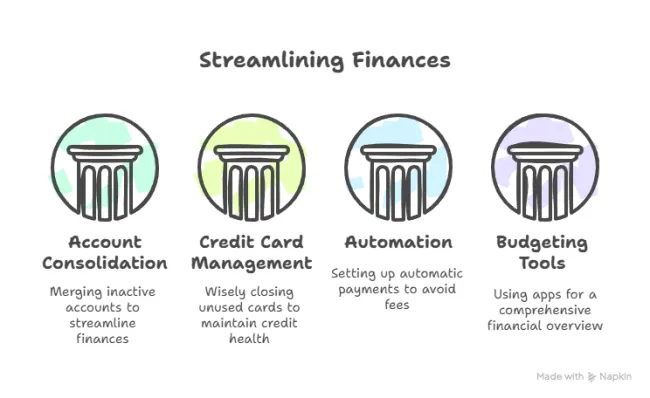

✔️ Consolidate old accounts: If you have inactive bank accounts, retirement funds, or credit cards, consider rolling them into one.

✔️ Close unused credit cards wisely: If an old card has no annual fee and helps your credit utilization ratio, keep it open. Otherwise, closing excess accounts can simplify your finances.

✔️ Automate your savings and bill payments to avoid missed due dates and late fees.

📌 Pro Tip: Use a budgeting tool or personal finance app to get a snapshot of all your accounts in one place!

🔹 Related Read: The Best Budgeting Methods for Your Lifestyle

Step 2: Review Your Spending & Budget

Why It Matters:

A budget isn’t about restriction—it’s about aligning your spending with what truly matters to you.

Action Steps:

✔️ Analyze the past 3-6 months of expenses to identify trends.

✔️ Cut out unnecessary expenses (subscriptions, impulse purchases, unused memberships).

✔️ Refine your budget using a method that fits your lifestyle (50/30/20 rule, zero-based budgeting, cash envelope system).

📌 Pro Tip: If traditional methods feel restrictive, consider a values-based budgeting approach that prioritizes what’s most meaningful to you.

🔹 External Source: How to Set and Stick to a Budget

Step 3: Organize Important Financial Documents

Why It Matters:

Having your financial documents organized ensures you can access what you need quickly and efficiently.

Action Steps:

✔️ Digitize important documents (bank statements, tax returns, insurance policies, estate plans, etc.) and store them securely.

✔️ Shred outdated or unnecessary paperwork to reduce clutter.

✔️ Ensure someone you trust knows where to find critical documents in case of an emergency.

📌 Pro Tip: Create a "Financial Emergency Binder" with essential information for your loved ones in case they need to access important accounts.

🔹 Related Read: How to Build an Emergency Fund

Step 4: Refresh Your Financial Goals

Why It Matters:

Goals evolve over time, and your financial plan should adapt to reflect your current priorities.

Action Steps:

✔️ Reassess your short-term and long-term financial goals. Are they still relevant?

✔️ Break big goals into small, actionable steps with deadlines.

✔️ Adjust your savings or investment contributions to align with your updated goals.

📌 Pro Tip: Visualizing your goals (like a savings tracker or dream board) can keep you motivated to stay on track!

🔹 External Source: The Psychology of Goal-Setting for Financial Success

Step 5: Check Your Credit & Protect Your Finances

Why It Matters:

A strong credit score saves you money on interest rates, while fraud prevention protects your hard-earned assets.

Action Steps:

✔️ Get a free copy of your credit report (via AnnualCreditReport.com) and check for errors.

✔️ Dispute inaccuracies immediately to maintain a strong credit score.

✔️ Set up fraud alerts or consider a credit freeze if you’re at risk of identity theft.

✔️ Update your insurance policies (life, health, home, auto) to ensure you have adequate coverage.

📌 Pro Tip: Consider using a password manager to secure sensitive financial logins!

🔹 Related Read: Understanding Your Credit Report

Final Thoughts: Take Control of Your Finances This Spring

Spring is the perfect time to reset and refresh, and your finances deserve the same attention as your home. By following these five steps, you can declutter, streamline, and set yourself up for financial success in the months ahead.

📩 Ready to take action? Schedule a time to discuss your financial goals with Melissa Cox. 🚀

FAQs: Spring Cleaning Your Finances

1. How often should I review my finances?

Ideally, you should review your finances at least once per year, but checking in every quarter can help keep you on track.

2. What are some tools to help me organize my finances?

Consider using apps like Mint, YNAB (You Need a Budget), or Personal Capital to track expenses and investments.

3. Should I keep physical copies of financial documents?

It’s good to have digital backups, but keep physical copies of wills, estate plans, insurance policies, and tax documents in a secure place.

4. What’s the best way to handle old retirement accounts?

If you have old 401(k)s, consider rolling them into an IRA or consolidating them into a current employer plan for easier management.

5. How can I make budgeting less overwhelming?

Start with small steps. Automate savings, track expenses with an app, and set realistic goals to make budgeting feel manageable.