CAREER CASH: MASTERING MONEY IN YOUR 20S AND 30S

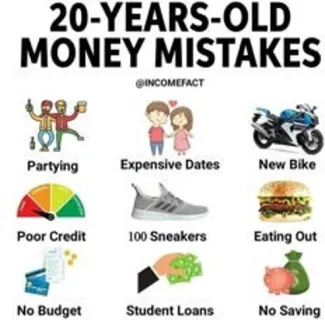

Congratulations! You’ve graduated from college and are entering the exciting world of full-time employment. Now what? With *hopefully* a steady income, it’s time to learn and master your money to set yourself up for a financially secure future. Your 20s and 30s are critical decades for good financial habits , tackling student debt, and making smart investments.

As a Certified Financial Planner™ (CFP), I’ve had the privilege of working with many clients who are navigating this same phase of life. It's important to understand the challenges and opportunities that come with this stage, and the goal is to feel confident and empowered as you make important financial decisions. Here are some essential tips to help you get started on the right foot.

Set Clear Financial Goals

Just like you set academic goals in college, it’s important to set financial goals now. Goals give you direction and motivation. Here’s how to start:

Short-Term Goals: These might include building an emergency fund, paying off a credit card, or saving for a vacation.

Mid-Term Goals: Consider purchasing a car, buying a house, or starting a business.

Long-Term Goals: Focus on retirement savings, wealth-building, and financial independence.

Write down your goals, make them specific and measurable, and set deadlines to keep yourself accountable.

Create a Realistic Budget

A budget is your financial roadmap. It helps you track income and expenses, ensuring you live within your means and save for future goals. Here’s a simple way to get started:

Track Your Income: Note your monthly salary after taxes.

List Your Expenses: Include fixed expenses (rent, utilities, loan payments) and variable expenses (groceries, entertainment, dining out).

Allocate Funds: Use the 50/30/20 rule—50% for needs, 30% for wants, and 20% for savings and debt repayment Stick to your budget and adjust it as your income or expenses change.

Build an Emergency Fund

Life is unpredictable, and having an emergency fund can provide a financial safety net. Aim to save three to six months’ worth of living expenses to start your emergency fund, and build up to having a year's worth of expenses in your cash reserves. This fund will help you cover unexpected costs like medical bills, car repairs, or job loss without going into debt.

Tackle Student Debt Strategically

Student loan debt can feel overwhelming, but with a strategic plan, you can manage it effectively:

UnderstandYourLoans: Know the types of loans you have (federal or private), interest rates, and repayment terms.

Choose the Right Repayment Plan: Federal loans offer various repayment plans, including income-driven repayment options. Choose one that fits your financial situation.

Consider Refinancing: Refinancing your student loans can lower your interest rate and monthly payments if you have good credit.

Make Extra Payments: Whenever possible, make extra payments towards your principal to reduce the total interest you pay over the life of the loan.

Start Investing Early

The earlier you start investing, the more time your money has to grow. Compound interest is your best friend when it comes to building wealth. Here are some investment tips:

Employer-Sponsored Retirement Plans: If your employer offers a 401(k) or similar plan, contribute enough to get the full company match. It’s essentially free money.

Individual Retirement Accounts (IRAs): Consider opening a Roth or Traditional IRA for additional retirement savings. Diversify Your Investments: Don’t put all your money in one basket. Spread your investments across stocks, bonds, and other assets to reduce risk.

Invest in Low-Cost Index Funds: These funds offer diversification and lower fees, making them a smart choice for long-term investors.

Build and Maintain Good Credit

Your credit score affects your ability to borrow money, rent an apartment, and even get a job. Here’s how to build and maintain good credit:

Pay Bills on Time: Late payments can significantly damage your credit score.

Keep Credit Card Balances Low: Aim to use less than 30% of your available credit.

Avoid Opening Too Many Accounts: Each application for credit can slightly lower your score.

Check Your Credit Report: Regularly review your credit report for errors and dispute any inaccuracies.

Continue Your Financial Education

The financial world is constantly changing, and staying informed is crucial. Read books, take online courses, and follow reputable financial blogs to expand your knowledge. Understanding personal finance will help you make informed decisions and adapt to economic changes.

Conclusion

Mastering money in your 20s and 30s sets the foundation for a secure financial future. You can achieve financial success by setting clear goals, creating a realistic budget, building an emergency fund, tackling student debt, starting to invest, and maintaining good credit.

Remember, it’s never too early to start planning your financial future. Stay focused, stay informed, and enjoy the journey towards financial independence.

Whether you’re figuring out how to budget, pay off loans, or start investing, I’m here to offer guidance that’s tailored to your unique goals and aspirations. Together, we can build a strong financial foundation that supports your dreams now and for the future. Please call or email to schedule an appointment with me, and let's create a financial plan that makes you feel comfortable and confident in your financial future.

FAQs

- What’s the first step to managing my money after college? Set clear financial goals and create a realistic budget to track your income and expenses.

- How can I effectively manage my student loan debt? Understand your loans, choose the right repayment plan, consider refinancing, and make extra payments towards your principal when possible.

- Why is it important to start investing early? Starting early allows your money more time to grow through compound interest, significantly increasing your wealth over time.

- How can I build good credit? Pay your bills on time, keep credit card balances low, avoid opening too many accounts, and regularly check your credit report for errors.

- What resources are available to continue my financial education? Books, online courses, and reputable financial blogs are excellent resources for expanding financial knowledge.

Until next time...this is Melissa Making Cents!

Melissa Anne Cox CERTIFIED FINANCIAL PLANNER™ is also a College Planning and Student Loan Advisor in Dallas, Texas