From Wants to What Matters: Aligning Your Money with Your Values and Priorities

Financial Clarity Starts with What Truly Matters

As a CERTIFIED FINANCIAL PLANNER™ and the founder of Future-Focused Wealth, I believe that great financial plans aren’t built from generic spreadsheets—they’re built around real people, real values, and what matters most to you. This is what client-centric financial planning is all about.

More than just numbers, budgets, and charts, financial wellness starts with aligning your money with your mindset, your goals, and your guiding principles. It’s part of the Future-Focused Wealth movement: planning not just for retirement or big milestones, but for purpose, peace of mind, and meaningful progress every day.

Let’s talk about how to create a plan that reflects your whole life—by exploring the difference between needs, wants, personal principles, and priorities.

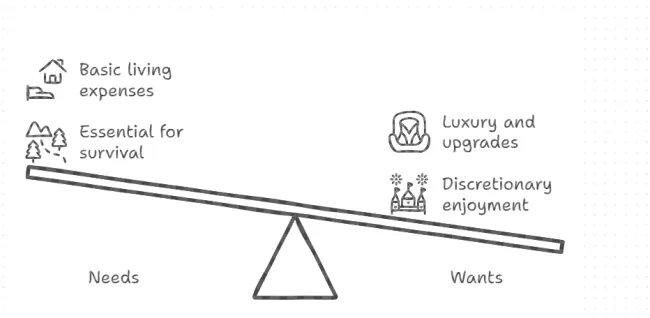

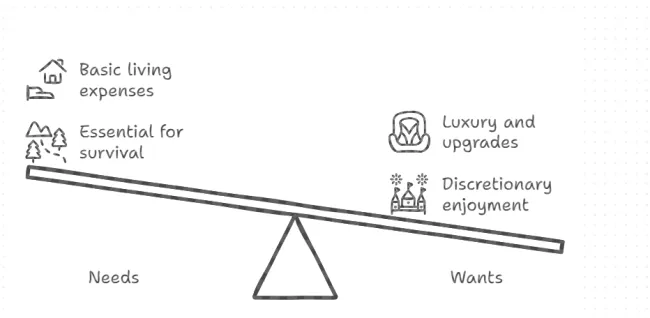

Needs vs. Wants: Understanding the Core Difference

Financial stress often comes from confusion between what we need and what we want. In theory, it sounds simple. But in real life, it can be murky.

Needs are essentials for living and working—housing, utilities, groceries, insurance, transportation, and basic health care.

Wants are everything else. They include luxury items, upgrades, convenience purchases, entertainment, and impulse buys.

📌 Example: A car might be a need—but a luxury SUV with the top trim is likely a want.

Understanding the difference allows you to:

- Prioritize spending more effectively

- Build a more flexible budget

- Avoid guilt and resentment when you do spend on wants

👉 Tip: When budgeting, try the 50/30/20 rule: 50% needs, 30% wants, 20% savings/debt repayment.

Social Media Influence and the Pressure to Want More

In today's world, it's easy to let social media, influencers, and advertising steer our spending. We’re constantly shown curated lives and luxury purchases that may not reflect reality—or our personal goals.

But here's the truth: you are the only one who gets to decide what truly brings you joy.

Before you hit purchase on that high-ticket item—like a designer handbag or top-of-the-line tech—ask yourself:

- Does this truly align with my values?

- Am I buying this because I want it, or because others say I should?

- Would saving for it, rather than going into debt, feel more empowering?

📌 Example: You fall in love with an expensive handbag and put it on a credit card, disrupting your tight monthly budget. While the purchase brings temporary happiness, the debt causes ongoing stress. Saving up and buying it later may align more closely with your principles—and feel even more rewarding.

When your spending reflects your priorities, you’re more likely to feel fulfilled, not financially drained.

Read: Explore how psychology influences your financial decisions.

Identifying Your Financial Priorities

Once you distinguish between needs and wants, the next step is defining your priorities. These are the bigger-picture items that matter most in your life.

Your priorities might include:

- Retirement

- Paying off debt

- Saving for a home

- College funding for children

- Travel

- Philanthropy or giving back

Priorities help clarify decision-making. When values compete—like saving for a home versus planning a wedding—your clearly ranked priorities will guide you.

✅ Ask yourself: If I could only accomplish one financial goal this year, what would it be?

Personal Principles: Your Financial Compass

Your principles are the beliefs and boundaries you bring to money. These often stem from your upbringing, culture, experiences, or faith.

Common financial principles might be:

- “I never carry credit card debt.”

- “I invest in companies that align with my ethics.”

- “I tithe or donate a set percentage of my income.”

- “I value experiences over possessions.”

When your spending habits and goals don’t match your principles, you feel friction. That friction may show up as stress, guilt, or avoidance.

🧭 Clarifying your financial principles is like setting your internal GPS—it keeps your plan pointed in the right direction.

How to Build a Spending Plan That Reflects Your Values

Rather than building a “restrictive budget,” build a values-based spending plan. Here's how:

- List your top 3 financial priorities.

- Compare your actual spending against those values.

- Adjust until your dollars match your goals.

🎯 Example: If family time is a top priority, allocating more toward weekend trips may be more fulfilling than spending on takeout or tech gadgets.

What Happens When Values Compete?

Sometimes priorities clash:

- Saving for retirement vs. helping a parent or child financially

- Buying a dream home vs. paying off debt

- Traveling now vs. investing for the future

This is where client-centered planning shines. Working with a planner helps you:

- Talk through the emotional and logical sides of financial decisions

- Test different outcomes using planning software

- Build flexible plans that balance today and tomorrow

The goal isn't perfection—it’s alignment.

Read: How social media is driving financial FOMO and overspending.

Tools That Keep You Grounded

- Money journal: Reflect on what spending decisions felt good or misaligned.

- Weekly check-ins: 10-minute reviews of spending and values.

- Joy fund: A special category in your budget for spontaneous spending that aligns with happiness—not guilt.

Read: Helpful breakdown of common financial needs and wants.

Adapting Your Financial Priorities Over Time

Your values and financial priorities naturally shift as life changes. A plan that worked in your 20s might not make sense in your 50s.

Examples:

- In your 20s–30s: You might prioritize debt payoff, building savings, and exploring lifestyle choices.

- In your 40s–50s: Retirement planning, college savings, and long-term care strategies rise in importance.

- In your 60s and beyond: Income stability, healthcare, and legacy planning become core concerns.

This is why we recommend reviewing your financial goals and plan at least annually, and whenever major life changes occur.

Why Your Brain Fights Your Budget—and How to Win

Behavioral finance shows that even smart people make emotional money decisions.

Common pitfalls:

- Loss aversion: Fear of loss makes us overly conservative.

- Anchoring: Fixating on a past price, salary, or budget.

- Present bias: Choosing today’s wants over future needs.

🎯 Solution: Values-based planning can reduce these pitfalls by rooting decisions in what matters most—not just short-term emotions.

Myths & Misconceptions About Needs vs. Wants

- Myth: “If I budget, I can’t have fun.”

- Truth: A good budget prioritizes intentional joy.

- Myth: “Once I set priorities, they can’t change.”

- Truth: Your life evolves—and so should your financial strategy.

- Myth: “I should always choose needs over wants.”

- Truth: Spending on aligned wants can actually fuel motivation and happiness.

Learn: Boost your savings for a future that reflects what matters most.

The Future-Focused Wealth Approach

At Future-Focused Wealth, we believe the best financial plans are built with you—not for you. We start with who you are, what you value, and how you want to live.

Then we design a financial strategy that:

- Reflects your core priorities

- Adjusts as your life evolves

- Helps you build both financial security and personal fulfillment

This isn’t one-size-fits-all planning—it’s personalized, human-first, and always future-focused.

📩 Ready to align your plan with your priorities? Let’s talk. Schedule your free consultation:

FAQs: Aligning Money with Values

❓ How do I know if a purchase aligns with my values?

Ask yourself if it brings lasting joy, helps you reach a goal, or supports something you believe in. If not, it's likely just a want—not a true priority.

❓ Can I include wants in my budget without guilt?

Absolutely! Wants aren’t bad—so long as they align with your values and don’t jeopardize financial stability. Planning for joy is part of sustainable budgeting.

❓ What if my financial priorities shift over time?

That’s natural. We recommend reviewing your goals at least annually and updating them after major life changes like marriage, a career move, or having children.

❓ How do I get my spouse or partner on board?

Start with a shared conversation about values and long-term goals. When your plan reflects both of your priorities, compromise becomes easier.

❓ Do financial principles have to be strict rules?

Not at all. Think of them as guideposts that keep your plan in alignment—not rigid restrictions.